Since its inception, Performance Max (PMax) campaigns have worked one way, and one way only:

Assets go in, ‘stuff’ happens, results come out.

Due to the black box nature of PMax, marketers have never known what that ‘stuff’ is. Where exactly are our ads showing, and why? How are audience signals actually being used? Which assets are driving performance, and on which channels?

Unless you were a senior Google employee, you had no chance of ever peeking behind that curtain.

…Until now.

In a recent LinkedIn post, Google Ads Product Liaison Ginny Marvin surprised us all with the news that Google is introducing a major overhaul to PMax reporting.

We’re FINALLY getting new levels of transparency around channel performance, asset-level metrics, and search term reporting.

These updates are a direct response to persistent advertiser feedback, and represent Google’s most significant attempt yet to address PMax’s ‘black box’ problem.

Over the next few minutes, we’ll break down what’s changing, what it means for performance marketers, and where limitations still remain. Expect to learn all you need to know about the updates to:

- Channel-level reporting: cost data by channel

- Asset-level reporting: increased granularity across PMax, Search & Display

- Search term reporting: finally on par with Search campaigns!

We’ll also discuss:

- The implications for advertisers

- Where PMax transparency still falls short (and what you can do about it)

- What leading performance marketers think about the changes, and how they’re changing their strategies

Channel-level reporting: finally, cost data by channel

For most advertisers, this is the headline feature.

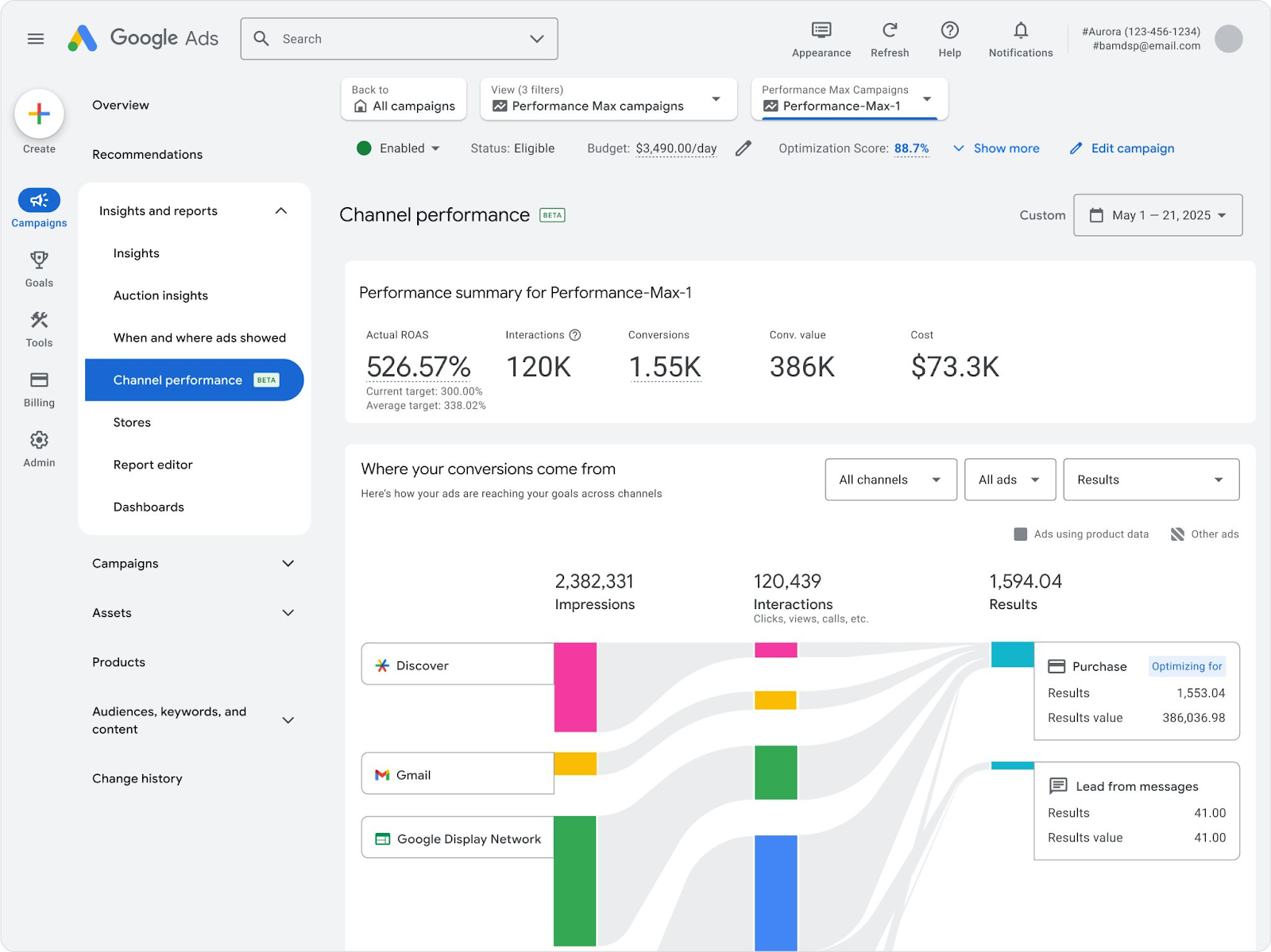

Channel-level performance reporting, with full visibility into key metrics - including cost, impressions, clicks, and conversions - broken down by platform.

This means we’ll be able to see exactly how PMax is spending across Search, YouTube, Display, Discover, Gmail, and Maps.

For many PPC marketers, this is like 10 birthdays all rolled into one.

What’s included:

- New interactive visualizations showing how each channel contributes to your goals

- Granular data tables with sortable metrics: impressions, clicks, cost, conversions, etc.

- Channel-level diagnostics to help you identify setup issues and understand how settings affect delivery

Google says the channel breakdowns can help advertisers:

- Optimize their product feeds and creative assets for top-performing channels

- Diagnose performance drops tied to individual surfaces

- Launch more targeted experiments and A/B tests

Importantly, this report also supports column customization and CSV downloads, allowing advertisers to pull the data into spreadsheets or dashboards for further analysis.

“In beta testing, advertisers used these insights to optimize assets and product feeds for channel performance, launch new experiments, and identify and address setup issues.”

Ginny Marvin, Google Ads Product Liaison

Why it matters

Until now, the all-encompassing PMax ‘black box’ meant marketers could only guess how their budget was being allocated across Google’s many surfaces. This opacity made it difficult to make informed decisions or justify performance fluctuations.

With this update, advertisers can:

- Compare cost efficiency by channel (e.g. is YouTube driving CPA up?)

- Understand which assets perform best on which surfaces

- Prioritize creative testing where it matters most

It’s a big step forward - but one that raises another question: why did it take this long?

Asset-level reporting: more granularity across PMax, Search & Display

Asset reporting has always been another weak spot for PMax. Advertisers could see which assets were labeled as “best” or “low” - but with no visibility as to why.

Fortunately, that’s changing.

Google will soon roll out asset-level reporting with actual performance metrics, including:

- Impressions

- Clicks

- Cost

Campaign types affected:

- Performance Max

- Search (responsive search ads and final URLs)

- Display (responsive display ads)

This means marketers will be able to identify high-performing images, videos, headlines, and descriptions, then act on that data to refine creative strategy.

Why it matters

PMax heavily relies on assets and automation - but until now, marketers have had to take Google’s “performance labels” on faith. With real numbers tied to individual assets, marketers can:

- Run real A/B tests across creative variants

- Remove underperformers with confidence

- Scale winners based on measurable impact

For large accounts managing multiple asset groups, this unlocks a much deeper level of optimization and control.

Previously, you could have two headlines marked “best” but never know which one was actually driving conversions. Now, finally, you’ll have the numbers to prove it.

Search term reporting: finally on par with Search campaigns

This one’s been a long time coming.

Advertisers have consistently asked for more insight into what queries are triggering their PMax ads - especially for shopping-heavy campaigns.

The good news: Search term reporting for PMax is now rolling out across accounts.

This includes the same level of detail as in standard Search and Shopping campaigns, showing:

- Actual search queries

- Match type data

- Campaign and asset attribution

Why it matters

Previously, search terms within PMax were only visible in Insights reports, and even then, only a vague “Top search themes” list was provided - no exact queries, no volume data, no ability to act on it.

With this update:

- Marketers can now analyze intent trends

- Filter out more irrelevant traffic

- Build negative keyword lists more effectively

This finally brings PMax closer to the standard expected from other Google campaigns - and, when used properly, can help advertisers combat wasted ad spend.

Implications for advertisers

Taken together, these updates represent a significant shift in how advertisers can manage, analyze, and optimize their PMax campaigns.

Here’s what it means in practice:

1. Greater transparency - resulting in smarter optimization

With visibility into channel costs and asset performance, marketers can fine-tune campaigns with greater precision - tweaking spend allocation, testing new creative, or refining targeting.

2. Campaigns can be held more accountable

If CPA suddenly spikes, you’re no longer guessing whether it’s due to YouTube or Search delivery. If conversion rates dip, you can isolate whether an underperforming asset is to blame.

3. Data-driven creative testing becomes possible

Gone are the days of making creative decisions based on Google’s vague “best” labels. You’ll now have hard performance data to guide which assets stay and which ones go.

4. It lays the groundwork for more informed budget allocation

Understanding how your ad dollars are split across Google’s ecosystem lets you prioritize based on actual ROI - and make the case to clients or stakeholders with real, tangible data.

Where PMax transparency still falls short

Despite these long-overdue upgrades, Performance Max still has a long way to go before it earns the full trust of performance marketers.

While the new reports finally scratch the surface of visibility, many core control levers remain off-limits. PMax is still PMax, after all.

1. No control over channel delivery - still

The headline update of channel-level reporting has been welcomed by many advertisers. But let’s not ignore the elephant in the room: it’s reporting only.

You can now see that YouTube is eating 45% of your PMax budget with a sky-high CPA… but you still can’t do anything about it.

There’s no way to opt out of individual channels like YouTube, Display, or Discover. There are no bid adjustments or delivery controls at the surface level. PMax’s algorithm continues to allocate spend based on its own opaque logic - whether you like it or not.

For advertisers looking to tighten ROI, this is a major roadblock. If a specific surface consistently underperforms, you’re stuck absorbing that inefficiency.

This ‘transparency without control’ model is like watching your house burn down through a window. Informative, but not helpful.

2. No ability to opt out of the Display Network

Unlike Standard Shopping or Search campaigns, PMax automatically includes the Display Network by default - and provides no way to opt out.

That’s a serious issue for brands who:

- Want to separate direct-response spend from upper-funnel awareness

- Need tighter control over brand safety and contextual relevance

- Are concerned about the quality of traffic from placements on low-value publisher sites

Even with new reporting on overall Display performance, placement-level data is still hidden, and exclusion controls are non-existent. This limits advertisers’ ability to protect budget or manage performance risk.

3. Placement transparency is still lackluster

While Performance Max campaigns now offer a Placement Report, this report is primarily designed for brand safety purposes and provides limited actionable data. Specifically, the report shows where ads have been served, such as specific websites, mobile apps, or YouTube videos, along with the number of impressions.

However, it lacks critical performance metrics like clicks, conversions, or cost, making it challenging to assess individual placements.

It still falls short of good ol’ Display or Video campaigns, which provide comprehensive placement reports that allow advertisers to see detailed performance metrics for each placement and make informed decisions about exclusions.

For Performance Max campaigns, placement exclusions are possible but come with limitations:

- Account-level exclusions: Advertisers can exclude specific placements at the account level, which affects all campaigns within the account.

- Campaign-level exclusions: To exclude placements at the campaign level, advertisers currently need to work with a Google representative, as this functionality is not directly available in the Google Ads interface.

These constraints mean that while some control is available, it is not as granular or accessible as in other campaign types. For brands with strict safety, compliance, or contextual relevance requirements, this remains a significant limitation.

4. Limited visibility into audience signal performance

Audience signals in PMax are best described as a suggestion to the algorithm - and that’s where your insight ends.

Once the campaign is live, you can’t:

- See how each audience is performing

- Compare results across custom segments or remarketing lists

- Use that data to inform future campaigns

This is a black hole for marketers who are used to refining their targeting based on data. It also means you can’t prioritize budget toward higher-performing audiences - or cut off those that aren’t working.

As a result, audience targeting becomes more of a hopeful hint than a strategic lever.

5. Asset-level reporting lacks channel context and conversion insight

The new asset-level reporting is a big step up from the old “Best” and “Low” performance labels. But even here, we’re only getting part of the picture.

Right now, the metrics provided (impressions, clicks, and cost) still leave key questions unanswered, such as:

- Which channels were these assets shown on?

- How were they paired with other creatives?

- What conversions can be attributed to specific assets?

This context is required for true creative optimization. Without it, marketers are still left making decisions in a vacuum.

Until conversion data is included - and ideally, segmented by channel - it’s difficult to tie asset-level performance to business outcomes.

6. Attribution remains opaque and inflexible

PMax defaults to data-driven attribution (DDA), and offers:

- No transparency into how credit is distributed across touchpoints

- No option to switch to first-click, last-click, or position-based models

- No integration with multi-touch attribution tools unless you heavily customize with offline tracking or third-party analytics

This makes it hard for marketers to:

- Prove incrementality

- Evaluate true campaign effectiveness

- Justify performance vs. other acquisition channels

In many cases, PMax is over-crediting itself for branded or retargeting conversions, while undervaluing the role of other upper-funnel efforts.

What Marketers are saying about the new PMax reporting

So, while the new reporting functionality is a welcome step in the right direction, it’s certainly not a fix-all for each and every problem we have with PMax.

Let’s take a look at what some of the best marketers in the business are reacting to the new reporting functionality, how effective they think it’ll be, and how they’re planning to make the most of it.

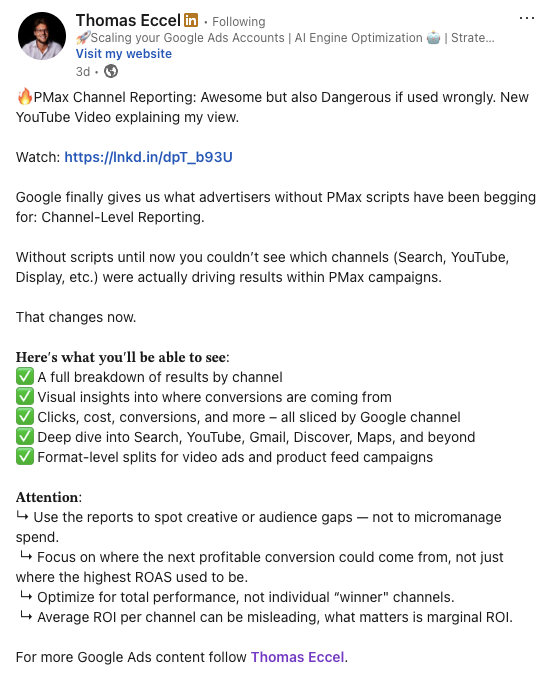

Google Ads Expert Thomas Eccel mentioned that the new channel reporting is “awesome” but dangerous if used incorrectly. He outlined the reasons why in his LinkedIn post below, but also created a video sharing how the new reporting can potentially be dangerous, and how he’s using the new reporting features going forward:

Commenting on Ginny Marvin’s announcement post, MD at Orchid Box Ben Quinney said out loud what most of us were thinking:

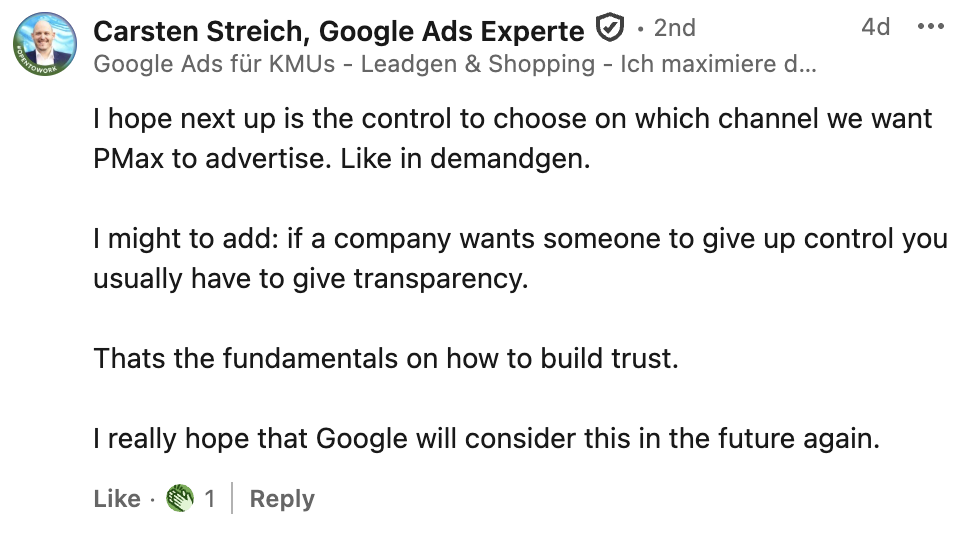

Carsten Streich echoed the frustration, stating that reporting doesn’t go far enough, and that real control over PMax channels is what we need:

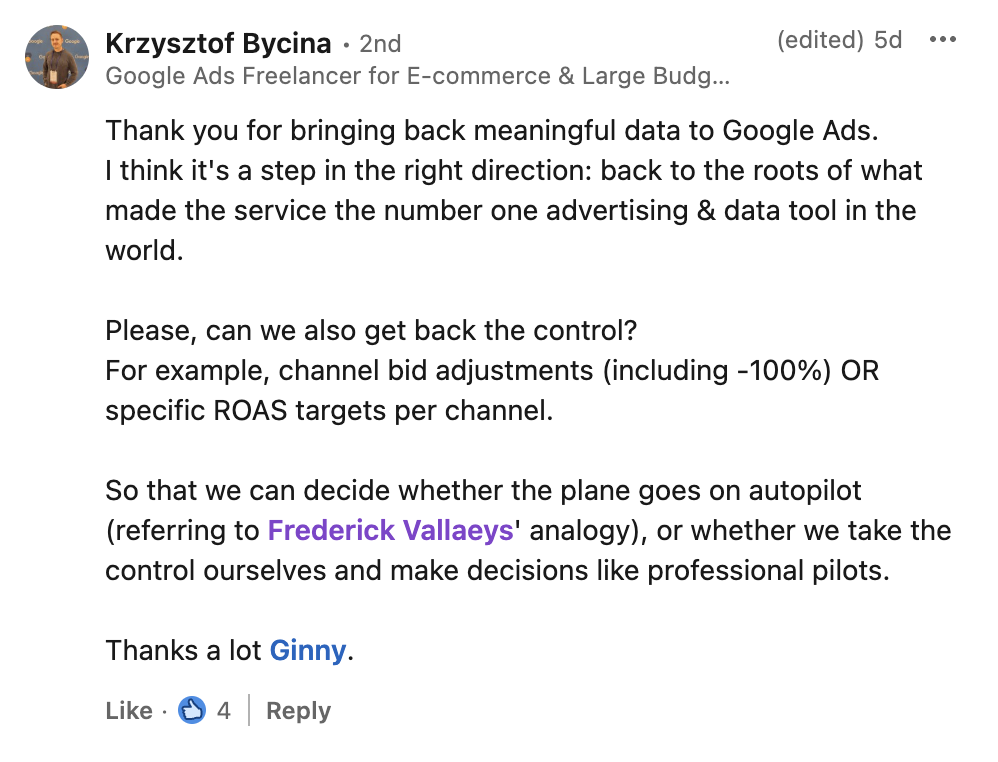

Google Ads Freelancer Krzysztof Bycina agreed that, whilst it’s certainly a step in the right direction, we should be able to ‘decide whether the plane goes on autopilot, or whether we take control ourselves like professional pilots’ (great analogy):

German marketing consultants AdHelden echoed the sentiment that key features are still missing - such as the ability to opt-out from the Display Network:

Benjamin W. provided his take in a post, stating that Google is super late with the feature, and that the ingenuity of marketing scripts and custom solutions has largely invalidated the new reporting - in other words, it’s too little, too late.

Andrew Buckman largely echoed our own sentiment here - saying the reporting is “something - but is it enough when we used to get so much more?”

Navah Hopkins, Brand Evangelist at Optmyzr, had a similar take to many of the marketers mentioned above.

Like us, Navah is hopeful this opens the door to future CPA/ROAS-based budget guidance, but warns it may frustrate marketers who can now see issues without being able to act on them:

Ultimately, nobody is saying these changes are bad. Far from it. In the barren desert of PMax visibility, even a small drop of water can go a long way.

But in order to get to the river of transparency, marketers need to keep pushing for increased visibility and control from their ad platforms - especially in an age where advanced automation is being handed more power than ever.

Final thoughts

After years (and years, and years) of advertiser pressure, Google is finally allowing marketers to take a peek into the ‘black box’ of its most opaque campaign type. For performance marketers, this means:

- Better decisions

- Smarter optimization

- Less reliance on guesswork

While this is promising, for Google to fully regain the trust of marketers, we’ll need more than just a slight peek.

Without true channel exclusions, deeper audience insights, and richer conversion attribution for assets, PMax still can’t match the control offered by Search or Display campaigns.

Marketers want that black box to be fully lit up, and on display to poke, prod, and experiment with. They want a deep, technical understanding of the ad platforms they’re using - not just a few more insights into what the almighty PMax machine is doing this week.

That said, the foundation is now in place. These new reporting features are a significant step in the right direction, and can help marketers gain fresh insights into their PMax campaigns. Lets just hope this change is the first of many aimed at giving marketers more control over their ad campaigns.

Want to make sure your PMax campaigns are only reaching real users, and aren’t wasting ad spend on bots or junk traffic?

Lunio can help you eliminate wasted spend and improve ROI across all paid channels. Learn more about how Lunio works and get a 14 day free traffic audit to see how much of your traffic is invalid.